See the latest Instructions for creating the TK1-TS form 2023 according to Decision 490/QD-BHXH

Download the D02-LT excel file here

SETUP INSTRUCTIONS

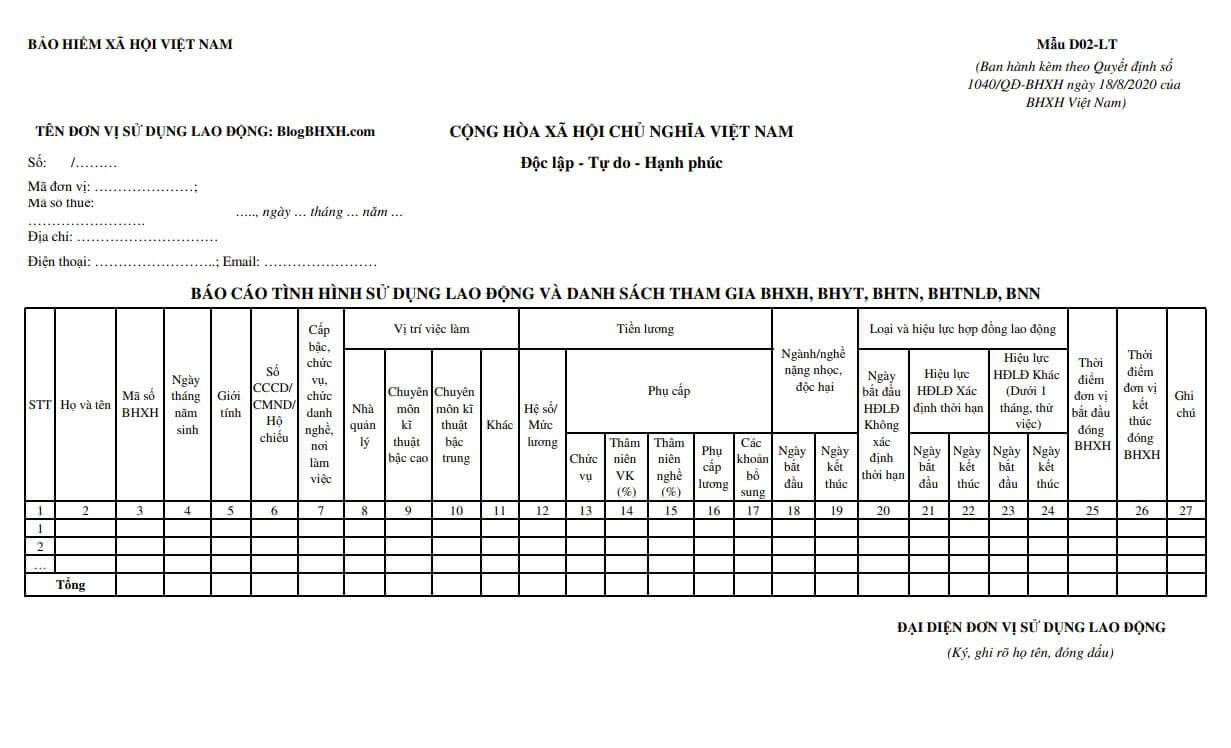

Report on employment situation and list of participants in social insurance, health insurance, and unemployment insurance (Form D02-LT)

- a) Purpose: for units and businesses to register; Collection and adjustment of social insurance, health insurance, unemployment insurance, occupational accident and occupational disease insurance; issue social insurance books, health insurance cards and declare the employment situation for employees of the unit.

- b) Responsibility for establishment: employing unit.

- c) Establishment time: when there are issues related to labor, wages and arrears for employees of the unit.

- d) Basis for establishment

- Declaration of participation in social insurance and health insurance (Form TK1-TS);

- Labor contract, employment contract, recruitment and reception decisions; decide on salary increases and transfers;

- Other relevant records.

d) Preparation method

* General information section

- Unit name: write the full name of the unit according to the business registration and establishment decision.

- Unit code: write the unit code issued by the social insurance agency.

- Tax code: write the tax code issued by the tax authority.

- Address: write the address where the unit's headquarters is located.

- Phone: write the unit's phone number.

- Email: write the unit's email name.

* Criteria by column:

- Column (1): Record numbers from smallest to largest.

- Column (2): Clearly state the full name of each employee.

For units with a large number of health insurance participants and requiring grouping of subjects to facilitate the receipt and return of health insurance cards, the social insurance agency is responsible for guiding the units when making a card issuance list. Health insurance, in column (2) is separated into groups according to affiliated unit codes (groups and affiliated unit codes are built by the unit itself but must not exceed 6 characters denoted by numbers or letters).

For example: Company A has 02 affiliated workshops, each workshop has 50 employees, then when Company A makes a list, it is divided into 02 groups: Workshop 1, code 01, accompanied by a list of 50 employees belonging to the company. Workshop 1; Next is Workshop 2, code 02, accompanied by a list of 50 employees of Workshop 2 (affiliated unit codes can be 01, 02 or AA, AB or more characters but not more than 6 characters). ).

- Column (3): Enter the code for people who already have a social insurance code.

- Column (4): Write the full date, month, and year of birth as shown in the birth certificate or identity card/citizen identification card/passport.

- Column (5): Record the gender of the participant (if male, write the word "male" or if female, write the word "female").

- Column (6): Record the participant's citizen identification number/identity card/passport issued by the competent authority (Passports are only for foreigners).

- Column (7): Fully and detailed record of rank, position, occupational title, job, workplace conditions according to the decision or labor contract, employment contract (For example: Deputy Chief Inspector of Department A, Public Works Industrial sewing machine operator at Company B...).

- Columns (8), (9), (10), (11): Sort by: managers; high level technical expertise; middle-level technical expertise; office assistant; service and sales staff; skilled workers in agriculture, forestry and fisheries; Craftsman; machinery and equipment operators and assemblers; simple labor.

- Column (12): Record the salary received:

+ For employees implementing the salary regime prescribed by the State, write in coefficients (including the reserved difference coefficient, if any).

For example: If the salary stated in the recruitment decision or contract is 2.34, write 2.34.

+ Employees implementing the salary regime decided by the employer shall write the salary according to job or title, in Vietnamese Dong.

For example, if the employee's salary is 52,000,000 VND, write 52,000,000 VND.

- Columns (13), (14), (15): Record position allowances by coefficient; Allowances for seniority beyond the frame and career seniority are equal to the percentage (%) in the corresponding column. If you do not receive any allowance, leave it blank.

- Column (16): Record salary allowances according to labor law regulations (if any).

- Column (17): Record other additional amounts according to the provisions of labor law from January 1, 2018 (if any).

- Column (18): Record the date, month, and year of starting to work in a heavy, hazardous industry/occupation.

- Column (19): Record the date, month and year of ending working in a heavy and hazardous industry/occupation.

- Column (20): Record the date, month and year of starting work under an indefinite-term labor contract.

- Column (21): Record the effective date, month and year of the fixed-term labor contract.

- Column (22): Record the date, month and year of expiration of the fixed-term labor contract.

- Column (23): Record the effective date, month, and year of another labor contract (less than 1 month, probation).

- Column (24): Record the date, month and year of expiration of another labor contract (less than 1 month, probationary period).

- Column (25): Record the date, month and year the unit starts paying social insurance for employees.

- Column (26): Record the date, month and year the unit ends (stops) paying social insurance for employees.

- Column (27): Record number; date, month, year of the labor contract, employment contract (specify the term of the labor contract, employment contract from day, month, year to day, month, year) or decision (recruitment, reception); Temporarily suspend labor contracts, leave work without pay...". Write down the subjects who are entitled to higher health insurance benefits if they have documents to prove it, such as: people with meritorious service, veterans, etc.

Note:

+ If during the month the unit prepares multiple lists of employees paying social insurance, health insurance, and unemployment insurance, number the lists.

+ The unit declares fully and accurately the salary paid for social insurance, health insurance, unemployment insurance, and labor accident and occupational disease insurance of each employee according to the provisions of law and is responsible for preparing the documents; Store records of participation in social insurance, health insurance, unemployment insurance, occupational accident and occupational disease insurance.

+ In case the employee only participates in occupational accident and occupational disease insurance, write it in the notes section (column 27) similar to above.

+ In case the unit reports an increase in labor for employees who already have a social insurance code, write all the criteria on the form and write the place of initial medical treatment registration in column 27.

+ In case the unit has many people changing the place of initial medical treatment registration, write column (2), column (3) and write the content of changing the initial medical treatment registration place in column 27, leave the other columns blank.

- e) After completing the declaration, the unit signs, writes full name, and stamps.